Ethereum Set For Further Decline As MVRV Signals Bearish Momentum! Here’s The Expected ETH Price Dip

Ethereum has seen a considerable decline in recent hours, following Bitcoin’s struggle to keep its momentum within the $38K-$40K mark. This situation has plunged Ethereum’s market dominance, as it finds difficulty in attracting buyers around its support levels. Currently, the market behavior hints at a further decline as a crucial on-chain metric shows selling opportunities. As a result, there’s a bearish threat for ETH price as it could record another dip in the coming hours.

Profitable Addresses Look For Selling Opportunities

Recently, Ethereum (ETH) witnessed a notable price fall from its peak of $2,400, now targeting the $2,100 level. This shift resulted in a wave of long position closures. According to Coinglass, Ethereum faced total liquidations over $77 million, with bullish traders contributing to approximately $70 million in liquidations, contrasted with about $7 million from bearish traders. This trend has established a stronger resistance near the $2,400 level due to continuous bearish pressure.

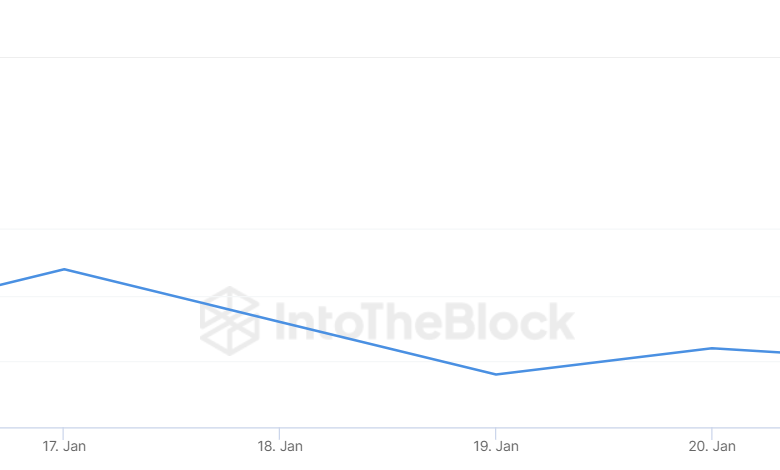

Yet, the potential for an even greater decline in ETH’s price looms, as a key on-chain metric suggests a correction. Data from IntoTheBlock shows that the Market Value to Realized Value (MVRV) ratio, an important indicator, points to a significant sell-off opportunity for Ethereum, particularly with its recent drop toward $2,100.

Currently, the MVRV ratio is at 1.49, suggesting that Ethereum’s market value significantly surpasses its realized value, or the value at the last transaction. This gap may lure traders to realize profits by selling their Ethereum holdings.

The ETH price tends to stabilize around a MVRV of 1.1, which could indicate a potential further decrease in its value. Meanwhile, the long/short ratio is showing signs of activity, trading at 1.1993, with 54.5% of positions anticipating a price increase and 45.5% predicting a drop.

What’s Next For ETH Price?

Efforts by bulls to push Ethereum past the $2,400 resistance were met with resistance, evident from a significant decline in the price chart. This led to a sharp crash in Ethereum’s price, falling below its moving averages and is now aiming to drop below $2,100. Currently, ETH is trading at $2,209, a 6.7% decrease from yesterday’s rate.

Ethereum’s price faces a significant test at $2,100 as it recently dropped below the ascending support line. However, buyers continue to defend the price and have quickly triggered a rebound above $2,200. Holding below this could strengthen bearish control, potentially bringing ETH down to the $2,000-$2,100 support area. However, a notable accumulation might be expected near that level.

The recent price behavior suggests ETH might fluctuate between $2,100 and $2,400 for quite some time. However, a break below $2,100 might send the price below the psychological level of $2K. On the other hand, a rebound and close above the EMA20 trend line might send the price toward $2,400 and then to $2,700.